nh meals tax calculator

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ss by 2504 eff 10.

The Meals and Rentals Tax is a tax imposed at a rate of 9 on taxable meals occupancies and rentals of vehicles.

. Use this app to split bills when dining with friends or to verify costs of an individual purchase. New Hampshires meals and rooms tax is a 85 tax on room. Annual Meals Rooms Tax Distribution Report Revenue to Cities and Towns MR Tax Homepage MR Tax Frequently Asked Questions.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Meals Rooms and Rentals Tax RSA 78-A. A calculator to quickly and easily determine the tip sales tax and other details for a bill.

New Hampshire Meals and Rooms Tax Database Author. LicenseSuite is the fastest and easiest way to get your New Hampshire meals tax restaurant tax. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

Van Buren Street Suite 100-321 Chicago IL 60607 Phone. Yes employers must provide in writing an employees rate of pay at the time of hire and upon any changes as well as all policies pertaining to any fringe benefits. Of such organization shall be subject to tax.

Exact tax amount may vary for different items. If you have a substantive question or need assistance completing a form please contact Taxpayer. 2022 New Hampshire state sales tax.

Tax is 500 or greater. 622009 93109 AM. Home page to the New Hampshire Department of Revenue Administrations website.

Please see the following New Hampshire Department of Revenue. Census Bureau Number of cities that. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

You may be required to file New Hampshire business tax returns if your gross business income exceeds 50000. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

Meals paid for with food stampscoupons. Rev 70104 Department means the New Hampshire department of revenue administration. New Hampshire income tax rate.

New Hampshire Department of Revenue. The employer must also. Motor vehicle fees other than the Motor.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Hampshire. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for.

Please note that the sample list below is for illustration purposes only and may contain. A 9 tax is also assessed on motor vehicle rentals. A 9 tax is also assessed on motor vehicle rentals.

Some schools and students. Contact Mailing Address. Well do the math for youall you need to do is.

NHDRA explains how to calculate property taxes as it releases new town tax rates. Usually the vendor collects the sales tax from the consumer as the consumer makes a. 0 5 tax on interest and dividends Median household income.

This includes hotel and room taxes fees other surcharges as well as New Hampshires 9 Meals and Rooms tax. New Hampshire Paycheck Quick Facts. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party.

Mcdonald S 1958 Mcdonald S Restaurant Mcdonalds The Good Old Days

Profits Of Selling Food Cooked Vs Raw Ingredients R Acnh

Pin On Converters Calculators Generators

New Hampshire Sales Tax Rate 2022

Fresh Kitchen Chef Inspired Bowls As Fast As You Can Point

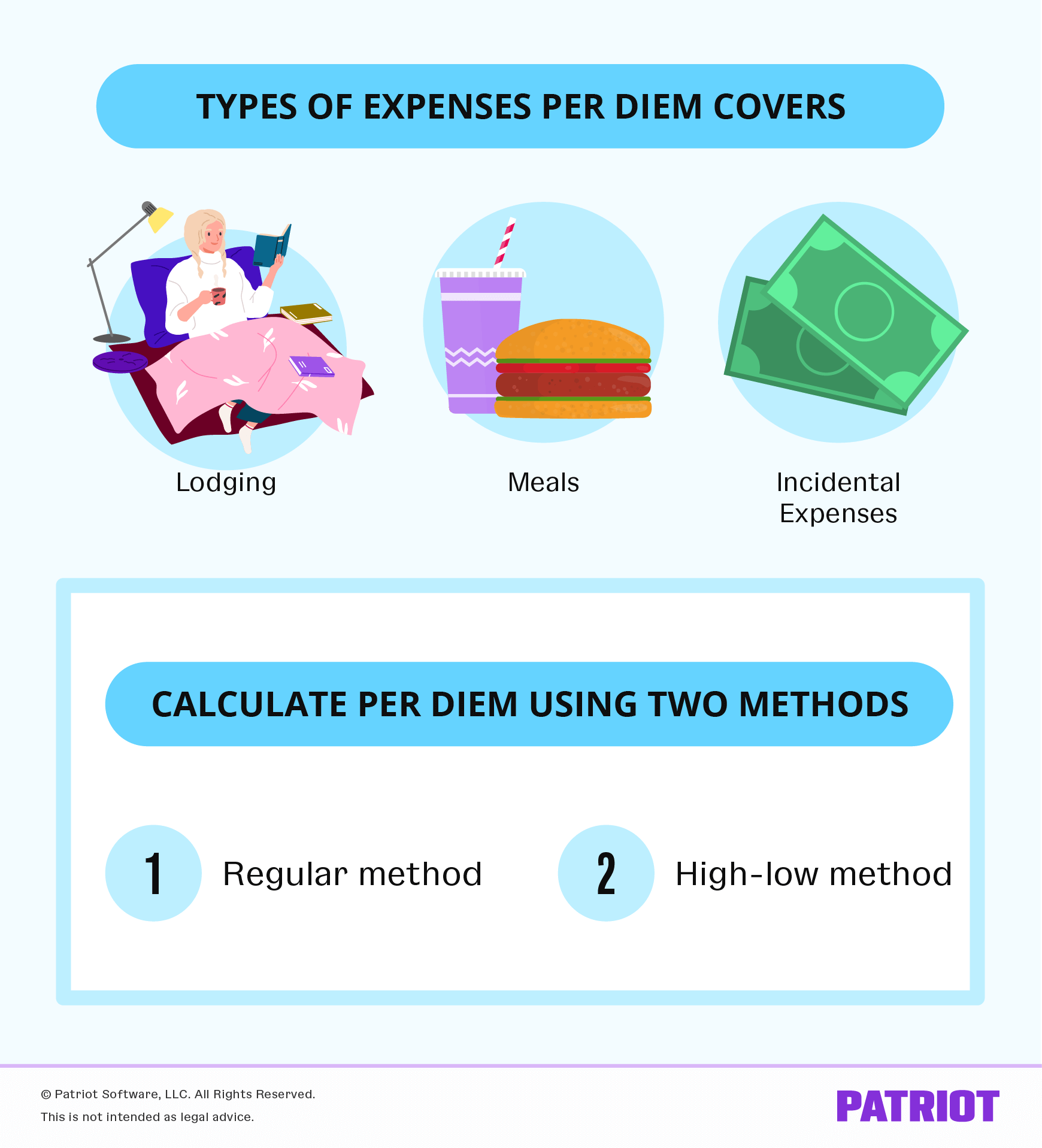

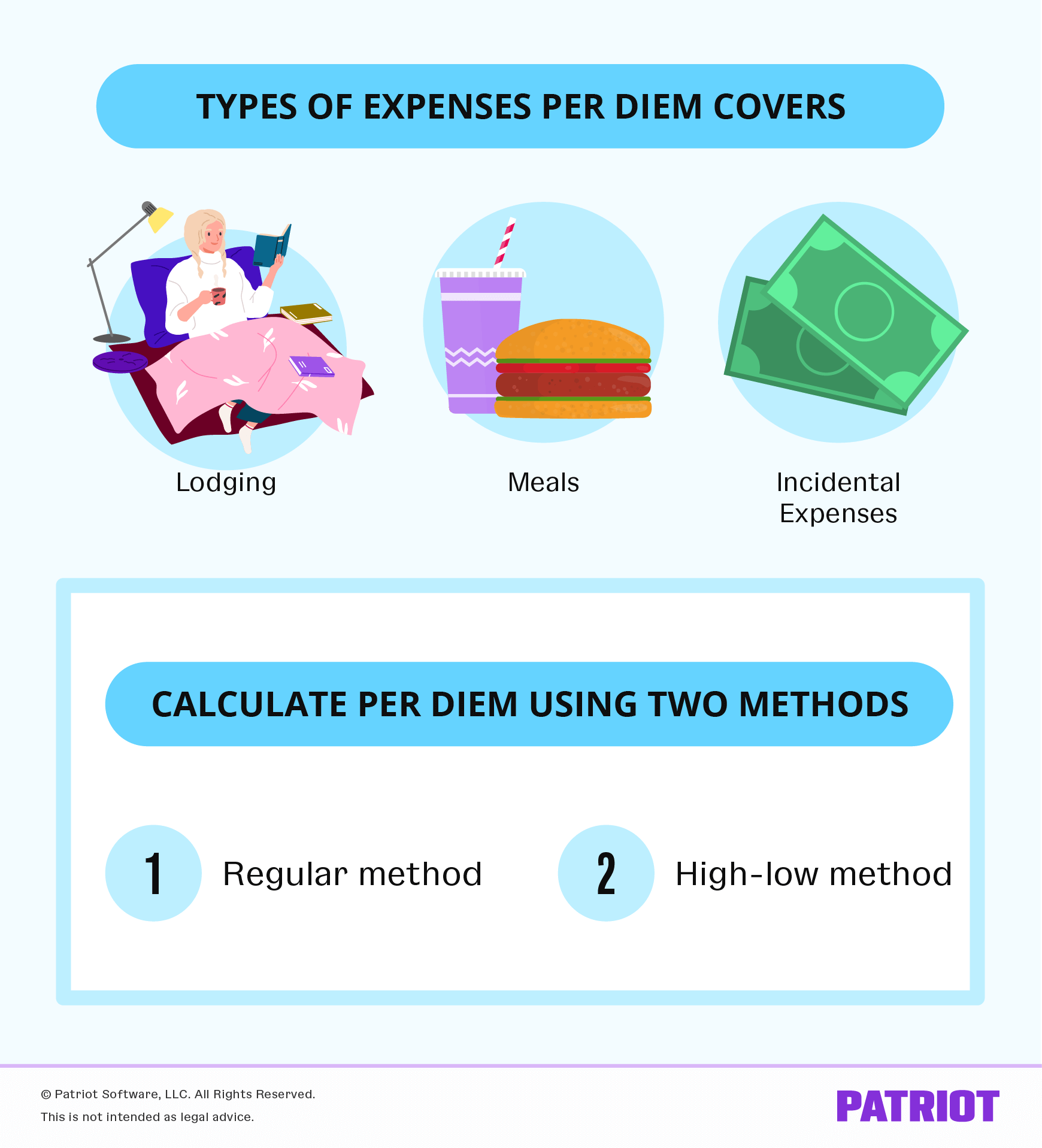

What Is Per Diem Definition Types Of Expenses More

Sales Tax On Grocery Items Taxjar

Calameo B2g Disposables Catalog

Stainless Steel Lunch Box Portable Leak Proof Student Insulated Max 73 Off

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Sales Tax Rate 2022

Stainless Steel Lunch Box Portable Leak Proof Student Insulated Max 73 Off

6 Piece Chicken Mcnuggets Happy Meal Mcdonald S

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Prep Sheets Kitchen Forms Chefs Resources Prep Kitchen Menu Planning Template Weekly Meal Planner Template

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Are Meal Plans Worth It For College Students Student Loan Hero

What Is The Meal And Entertainment Card And How Can This Benefit Be Used Salary Packaging Australia