stock options tax calculator usa

Use this calculator to determine the value of your stock options for the next one to twenty-five years. 16000 - 15000 1000 taxable income.

Quarterly Tax Calculator Calculate Estimated Taxes

This tool can help you estimate your capital gainslosses capital gains tax and compare short term vs.

. The wage base is 142800 in 2021 and 147000 in 2022. Long-term capital gain if youve already sold or are considering selling. The Stock Option Plan specifies the total number of shares in the option pool.

The plan was an incentive stock option or statutory stock option. Lets say you got a grant price of 20 per share but when you exercise your. Click to follow the link and save it to your Favorites so.

Taxes for Non-Qualified Stock Options. 40 of the gain or loss is taxed at the short-term capital tax. All thats necessary to calculate the value of startup stock options is A the number of shares in the.

This permalink creates a unique url for this online calculator with your saved information. You will only need to pay the greater of. Even taxpayers in the top income tax bracket pay long-term capital gains rates.

Locate current stock prices by entering the ticker symbol. The stock is disposed of in a qualifying disposition. As a result you have to pay withholding tax at the time of exercise.

Those shares could be worth 10 per share or 1000 per share. How much are your stock options worth. Ordinary income tax and capital gains tax.

The Stock Calculator is very simple to use. Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock. ISOs are tax free at exercise but you may be.

By changing any value in the following form fields calculated values are immediately. Exercising your non-qualified stock options triggers a tax. Stock Option Tax Calculator.

60 of the gain or loss is taxed at the long-term capital tax rates. There are two types of taxes you need to keep in mind when exercising options. Ad Understand the context of the options market with stats only available on Cboe LiveVol Pro.

In our continuing example your theoretical gain is. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. On the date of exercise the fair market value of the stock was 25 per share which is.

The results provided are an. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. This calculator reflects the Metro Supportive Housing Services SHS Personal.

The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. What will my options be worth if my companys stock price changes. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

When you hold your investment for over a year youll qualify for the. See prints live as they hit the tape and filter by notional premium delta IV and more. Calculate the costs to exercise your stock options - including taxes.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Exercise incentive stock options without paying the alternative minimum tax.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. Content updated daily for stock options tax calculator. Section 1256 options are always taxed as follows.

See prints live as they hit the tape and filter by notional premium delta IV and more. If the stock was disposed of in a nonqualifying disposition the basis is. Ad Understand the context of the options market with stats only available on Cboe LiveVol Pro.

Maximize your stock compensation gains and prevent. 4 HI hospital insurance or Medicare is 145 on all earned income. Maximize your stock compensation gains and prevent.

Local income tax rates that do not apply to investment income or gains are not included. The following calculator enables workers to see what their stock options are likely to be valued at for a range. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the. See your gain taxes due and net proceeds with this calculator.

This option lets you buy shares of your companys stock at a predetermined price called a grant price within a specific time frame. Ad This is the newest place to search delivering top results from across the web. If the value of the stock goes up you have.

Your payroll taxes on gains from. Employee Stock Option Calculator for Startups Established Companies. NSOs are reported as ordinary income when you exercise your options.

Income Tax Calculator Fy 2022 23 Calculate New And Old Regime Tax

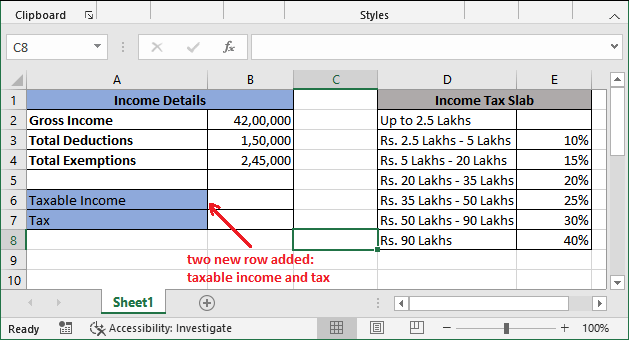

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Cannabis Taxes At Your Dispensary

How Much Should A Freelance Developer Charge In Berlin

Tax Calculator Figure Your 2021 Irs Refund Before Filing Your Return

Income Tax Calculating Formula In Excel Javatpoint

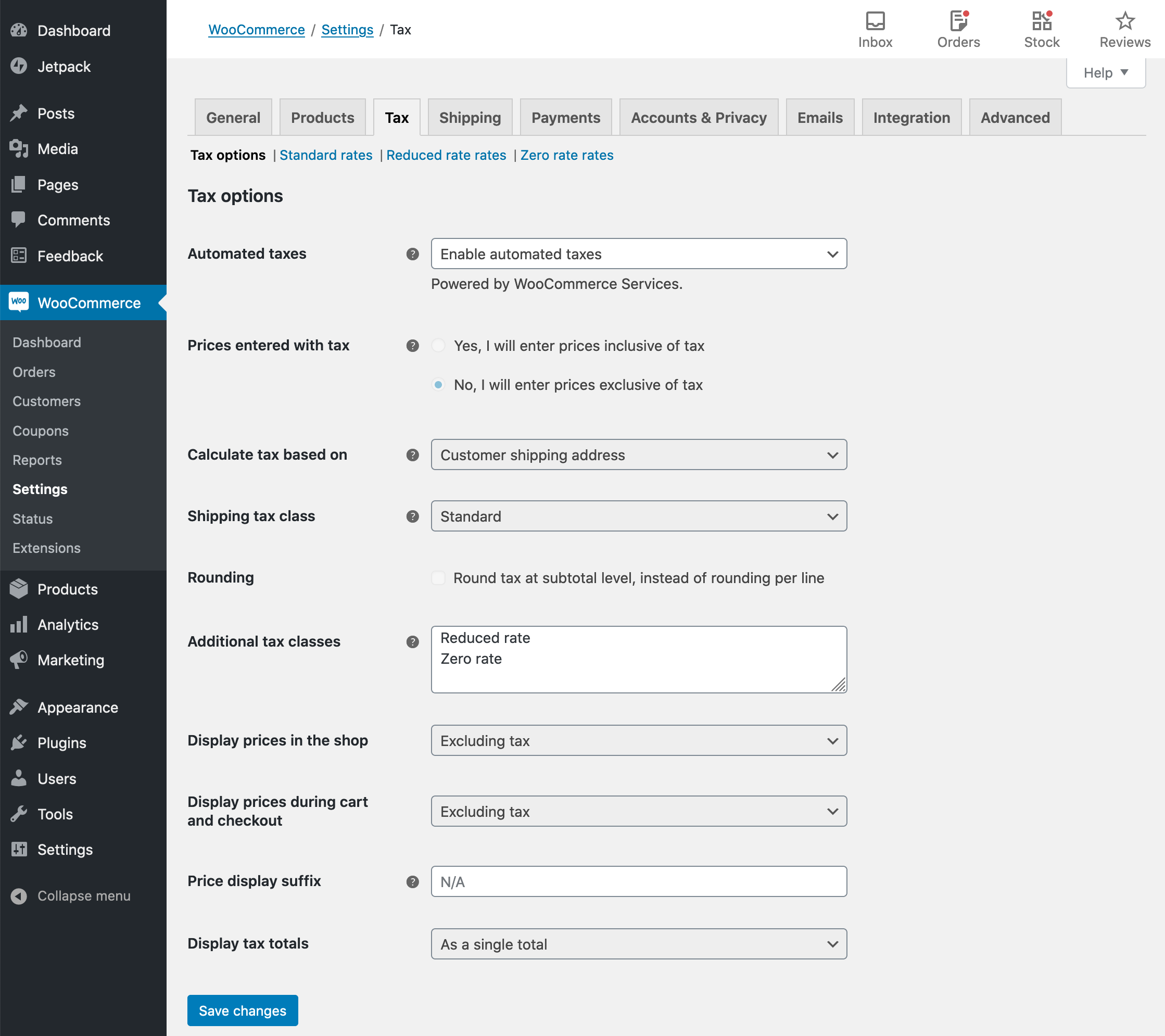

Woocommerce Tax Guide Woocommerce

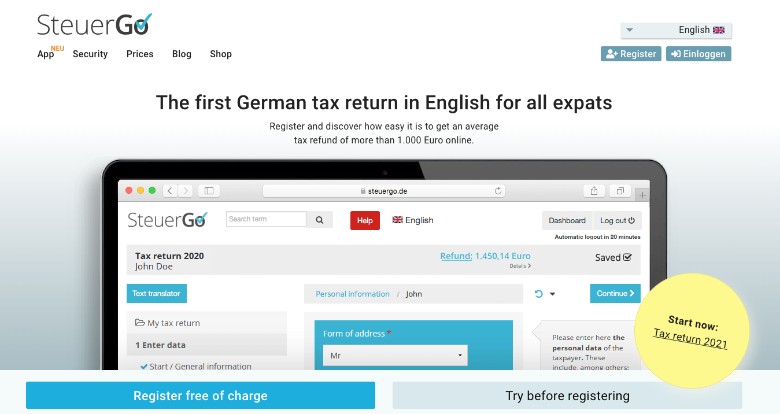

Best Tax Return Software In Germany 2022 English Guide

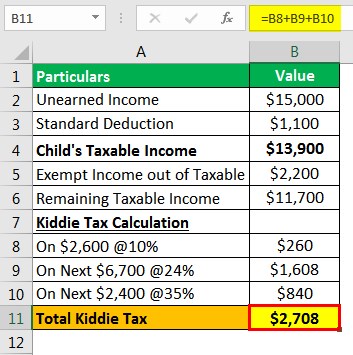

Kiddie Tax Meaning Example How To Calculate

Calculator Logo Tax Logo Bookkeeping Logo Cpa Logo Etsy Business Logo Premade Logo Design Brand Fonts

Capital Gains Tax Calculator 2022 Casaplorer

France Cryptocurrency Tax Guide 2021 Koinly

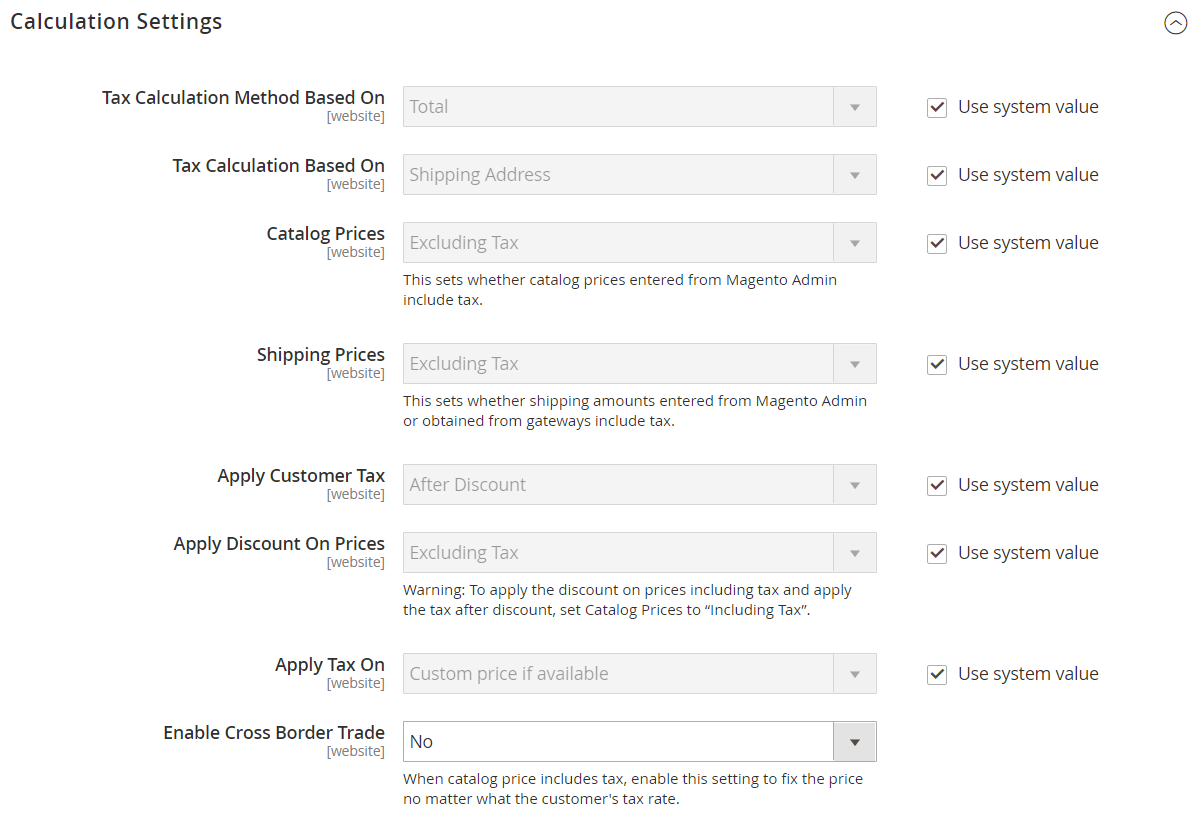

General Tax Settings Adobe Commerce 2 4 User Guide

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

Income Tax Calculator Fy 2022 23 Calculate New And Old Regime Tax

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube